Millville’s Override: Comparing Levy Usage & Future Revenue Plans

During a recent town meeting and on her Facebook page, Selectman Jennifer Gill provided a comparative look at the proposed Proposition 2 ½ overrides in several surrounding communities, shedding light on how Millville’s situation stacks up against its neighbors. But a key question remains: how do we ensure this isn’t a recurring issue? Let’s delve into the data, the town’s levy usage, and the plan for future revenue growth.

Understanding Levy Limits: A Simple Explanation

Before we dive into the numbers, let’s clarify what a “levy limit” is. Think of it as a town’s maximum property tax revenue allowed by state law. Each town has a “levy ceiling,” which is the absolute highest they could tax. The “levy limit” is the amount the town actually decides to tax, which cannot exceed the ceiling. The percentage of the ceiling used shows how close a town is to its maximum taxing capacity.

The Numbers Don’t Lie: Override Comparison & Levy Usage

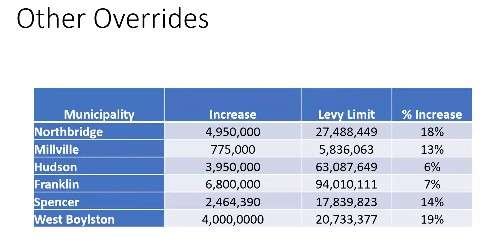

As Jennifer Gill illustrated in her presentation and on her Facebook page, Millville is seeking a $775,000 override. While this might seem like a large number, it’s important to consider it in context. Here’s what the data shows:

- Millville’s Percentage Increase: Millville’s override represents a 13% increase over its levy limit of $5,836,063. This is a significant jump, but not the highest among the towns presented.

- Comparison to Other Towns:

- Northbridge: Northbridge has the highest percentage increase at 18%, seeking an additional $4,950,000.

- West Boylston: West Boylston follows closely with a 19% increase, requesting $4,000,000.

- Spencer: Spencer is also higher than Millville at 14% with a $2,464,390 override.

- Hudson and Franklin: These towns have lower percentage increases at 6% and 7% respectively, but are seeking significantly larger dollar amounts.

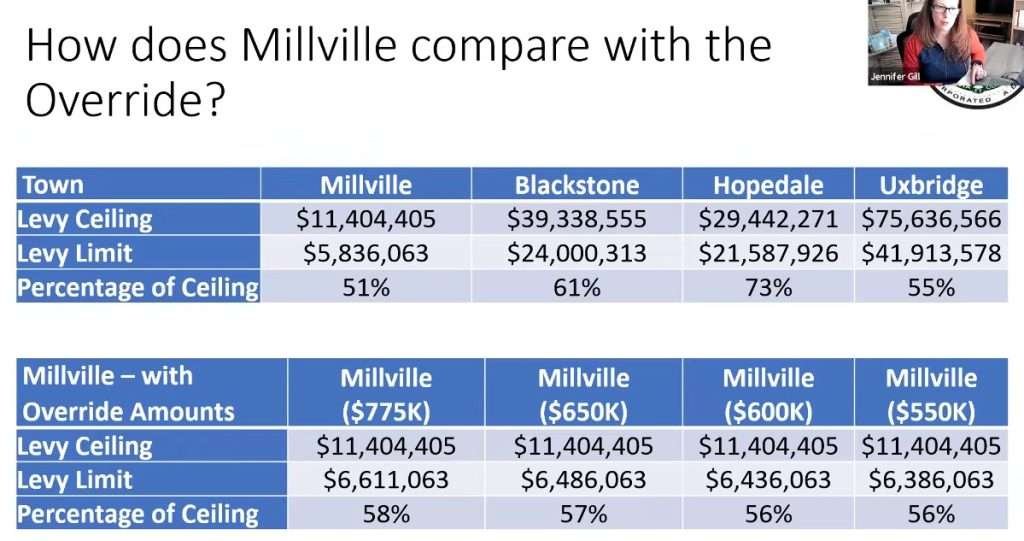

- Levy Usage Comparison:

- As shown in the new chart, Millville currently uses 51% of its levy ceiling.

- Blackstone uses 61%, Hopedale 73%, and Uxbridge 55%.

- This indicates that, despite having other revenue sources, these neighboring towns are utilizing a larger portion of their potential property tax revenue compared to Millville.

- Millville with Override Amounts:

- The chart also shows how the percentage of Millville’s levy ceiling increases with different override amounts.

- With the $775,000 override, Millville would use 58% of its levy ceiling.

- Even with the override, Millville’s levy usage remains lower than some neighboring towns.

Looking Ahead: Future Revenue Growth

Addressing concerns about recurring overrides, Jennifer Gill also presented a plan for increasing revenues moving forward. Potential revenue streams for FY 27, totals $473,000. These include:

- Increased Licenses & Permits ($33,000): Adjusting fees to better reflect costs.

- Building Consolidation ($20,000): Estimates from consolidating town buildings.

- New Growth – Thayer Development ($100,000): Revenue from new development projects.

- Managing Budgets to 2.5% Growth ($50,000): Strategic budget management.

- Annual Revenue ($170,000): Existing annual revenue sources.

- Free Cash ($100,000): Utilizing available free cash.

This plan, coupled with the $175,000 of remaining levy capacity, aims to stabilize the town’s finances and mitigate the need for future overrides.

What Does This Mean?

Selectman Gill’s presentation, shared both at the town meeting and on her Facebook page, highlights that while Millville’s override is substantial for the town, it’s not an outlier in the region. Furthermore, the revenue projection plan demonstrates a proactive approach to long-term financial stability. The levy usage comparison shows that Millville has been more conservative with its property tax revenue compared to some neighboring towns, even with the proposed override.

Key Takeaways for Millville Residents:

- Context is Key: It’s crucial to understand the override within the context of Millville’s budget and the needs of the town.

- Regional Trend: Millville is not alone in facing financial challenges. This is a trend seen across the region.

- Levy Usage: Millville has historically used a smaller portion of its levy ceiling compared to some neighboring towns.

- Future Planning: The town is actively planning for future revenue growth to reduce reliance on overrides.

- Informed Decision: This data provides valuable information for residents to make informed decisions about the upcoming vote.

What’s Next?

As the April 7th election approaches, it’s important for Millville residents to continue to educate themselves on the proposed override and its potential impact. You can find more information on Jennifer Gill’s Facebook page, where she has also shared a video (https://www.facebook.com/share/v/1BEdgyMueP/) further explaining the situation. Understanding how Millville’s situation compares to its neighbors and the town’s future revenue plans can help provide a broader perspective on the financial challenges facing our communities.